In 1997, Robert Kiyosaki published Rich Dad Poor Dad, a personal finance book. The book is about Kiyosaki’s life, his two fathers (one rich and one poor), and the lessons he learned from each of them about money and investing.

The book emphasizes the importance of financial education and literacy in achieving financial independence and building wealth. Kiyosaki argues that traditional schooling often fails to teach people about money, leading to financial struggles and debt. Instead, he advocates for learning about finance, investing, and entrepreneurship as critical components of financial success.

Throughout the book, Kiyosaki shares several vital principles and strategies for building wealth, including taking calculated risks, understanding the difference between assets and liabilities, and developing a “rich mindset” that focuses on creating passive income streams.

One of the most important concepts introduced in the book is the Cashflow Quadrant, which categorizes individuals into four groups based on how they earn money: employees, self-employed individuals, business owners, and investors. Kiyosaki argues that moving from the left side of the quadrant (employee and self-employed) to the right side (business owner and investor) is essential for achieving financial independence.

Understanding the Rich Dad Mindset

Rich Dad Poor Dad, written by Robert Kiyosaki and Sharon Lechter, is a personal finance book emphasizing the importance of financial education and literacy in achieving financial independence and building wealth. One of the key concepts introduced in the book is the importance of developing a “rich dad” mindset. This article will discuss the differences between the rich and poor attitudes and provide tips for cultivating a wealthy dad mindset.

The Rich Mindset vsThe Poor Mindset

Rich and poor mentalities are vastly opposite. Wealthy people have the perspective that they are in charge of their financial future and are prepared to take calculated risks to get where they want to go. They emphasize developing passive income streams because they view money as a tool for generating wealth. They also realize that in order to succeed financially, they must invest in themselves. They are prepared to commit the time and effort needed to learn about investment, entrepreneurship, and finance.

On the other hand, those with a poor mindset believe that their financial destiny is mainly out of their control. They see money as a scarce resource that needs to be hoarded and protected and are often afraid to take risks or invest in themselves. They may also have limiting beliefs about money and wealth, such as the idea that rich people are greedy or that it’s impossible to get rich without inheriting money.

The Importance of Having a Wealthy Mindset

A wealthy mindset is essential to achieving financial success, and this can be attained by adopting the proper habits and beliefs toward money. A wealthy perspective involves controlling your financial destiny, taking calculated risks, and seeing money as a tool to create wealth. This mindset also entails investing in oneself, learning about finance, investing, and entrepreneurship, and having a positive attitude toward money and wealth.

Cultivating a Rich Dad Mindset

So, how can you cultivate a wealthy dad mindset? Here are a few tips:

- Invest in yourself. One of the fundamental principles of the wealthy dad mindset is that you must invest in yourself to achieve financial success. This means taking the time and effort to learn about finance, investing, and entrepreneurship. Read books, attend seminars, and surround yourself with people who have a wealthy mindset.

- Focus on building passive income streams. Instead of relying solely on your salary, focus on creating passive income streams that generate income without requiring active involvement. This might include investing in stocks, real estate, or a business.

- Take calculated risks. Those with a wealthy mindset are willing to take calculated risks to achieve their goals. This doesn’t mean being reckless or making impulsive decisions but being ready to step outside your comfort zone and take actions that may lead to greater rewards.

- Avoid debt. Debt can be a significant obstacle to achieving financial success, as it can limit your ability to invest in yourself or build passive income streams. Avoid taking on unnecessary debt, and focus on paying off any existing debts as quickly as possible.

- Surround yourself with positive influences. Finally, surround yourself with people with a rich mindset who will support and encourage you in your pursuit of financial success. Avoid negative consequences and naysayers who may try to discourage you or bring you down.

Making Money Work for You

Robert Kiyosaki’s Rich Dad Poor Dad is a critically acclaimed book that offers a singular viewpoint on financial management and wealth generation. The author emphasizes that it is critical to ensure that one’s cash works for them instead of vice versa, as is usually the case. This can be achieved through various means, such as investing in dividend-paying shares or property and avoiding consumerism pitfalls. In this article, we will delve into passive income concepts, the significance of investment, and managing money efficiently in line with the teachings of Rich Dad Poor Dad.

The Meaning of Passive Income

Passive income refers to earnings made without active input. This can be accomplished through various means, including renting out a property, earning royalties, or through shares. In contrast to operational revenue, which necessitates you to put in time and effort for cash, passive income allows you to earn money as you sleep, take time off, or hang out with your loved ones.

Kiyosaki underscores the importance of earning a passive income to achieve financial freedom. He argues that relying on a job or traditional business is insufficient, given that these sources of revenue require continual effort and are dependent on market conditions. In contrast, passive income offers a dependable and sustainable revenue stream that supports your lifestyle and enables you to pursue your passions and interests.

The Significance of Investment

Investing is fundamental for generating passive income and creating wealth over time. Kiyosaki recommends investing in cash flow assets like rental property or dividend-paying shares rather than speculative investments reliant on market fluctuations. Concentrating on cash flow can create a stable and predictable revenue stream that can fund your lifestyle and provide financial security.

Kiyosaki also highlights the need for financial education in investing. He posits that most people require a better financial grasp and rely on outdated or flawed advice from financial experts or the media. By educating yourself about personal finance and investing, you can make informed decisions and avoid costly mistakes.

Getting Started with Investment

Getting started with investing can be daunting, but Kiyosaki provides practical advice for novices. He recommends starting small and focusing on cash flow assets you understand and can manage. This could entail purchasing rental property or investing in dividend-paying shares you have researched and feel confident about.

Kiyosaki also stresses the importance of taking calculated risks and being willing to learn from mistakes. He encourages readers to adopt the mindset of an entrepreneur, which entails enduring the initiative, being innovative, and adapting to change. By cultivating this mindset, you can become an intelligent investor who can identify and capitalize on opportunities.

Managing Your Money Effectively

In addition to investing, managing your finances effectively is essential for achieving financial freedom. Kiyosaki provides some pointers for managing your finances efficiently:

Control Your Expenses: Kiyosaki posits that most people spend too much on things that don’t contribute to their financial well-being. He urges readers to be mindful of their expenditures and prioritize investments that generate cash flow.

Create Multiple Streams of Income: Kiyosaki highlights the need to diversify your revenue streams. By creating multiple income streams, you can reduce your reliance on any one revenue source and enhance your financial stability.

Take Advantage of Tax Benefits: Kiyosaki recommends leveraging tax benefits, such as deducting expenses related to your investments or starting a business. Maximizing your tax benefits can lower your tax burden and boost your net income.

Focus on Assets, Not Liabilities: Kiyosaki distinguishes between assets, which generate income, and liabilities, which incur costs. He advises readers to focus on investments that create cash flow while avoiding penalties that incur expenses.

Building Wealth through Real Estate

Real property speculation is an established means of accruing prosperity and accomplishing fiscal autonomy. As articulated in the prominent book “Rich Dad Poor Dad” by Robert Kiyosaki, genuine land financing provides a consistent stream of revenue, significant tax advantages, and the likelihood of prolonged appreciation.

Therefore, what are the benefits of real property investment?

Cash Flow: Real property can yield uninvolved pay in the guise of rental revenue. If you invest in a rental real property, your renters remit rent every month, which can assist you in producing a predictable inflow of revenue.

Appreciation: The real property has the prospect of augmenting in value over time. As the property valuation grows, you can sell it for a profit or restructure it to gain access to the equity.

Tax Benefits: Real property financiers can capitalize on numerous tax advantages, for example, devaluation deductions, mortgage interest deductions, and property tax deductions. These tax advantages can aid in curbing your taxable revenue and saving you money.

Diversification: Real property financing allows you to diversify your investment portfolio, cutting down your risk exposure to other assets such as stocks and bonds.

How to get started in real estate investing?

Educate Yourself: Before you invest in real estate, it’s crucial to edify yourself about the sector. Read literature, attend workshops, and network with experienced real property investors to learn as much as you can.

Set Goals: Determine your investment objectives and what class of real property financing tactic you want to pursue. Is passive income your goal, or do you want to earn long-term appreciation?

Build a Team: Real property financing can be intricate, so it’s crucial to establish a team of experts, such as real property agents, barristers, accountants, and contractors, to assist you in navigating the procedure.

Find a Property: Once you’ve determined your investment objectives and built a team, it’s time to locate a property that meets your standards. Search for properties in desirable locales with substantial rental demand and potential for appreciation.

Finance the Investment: There are several ways to finance a real property investment, including conventional loans, private money loans, and hard money loans. Select the financing alternative that best fits your investment objectives and fiscal circumstances.

Some pointers for becoming a thriving genuine property financier.

Be Patient: Real property investment is a long game that takes time to realize noteworthy returns. Don’t rush into any investments, and always conduct due diligence.

Manage Your Risks: Real property financing comes with hazards, such as market fluctuations, property damage, and tenant issues. Alleviate these hazards by investing in quality properties, purchasing insurance, and scrutinizing tenants.

Stay Organized: Real property investment can be convoluted, so staying organized is essential. Keep thorough records of your assets, expenses, and income to control your finances.

Continuously Learn: Real property is constantly evolving, so it’s crucial to stay up-to-date with sector trends, regulations, and laws. Attend workshops, read industry publications, and network with other investors to stay informed.

Real property investment can be a potent means of accruing prosperity and accomplishing fiscal autonomy. By understanding the benefits of real property investment, getting started, and following these tips for success, you can establish a lucrative real property portfolio that provides passive income, long-term appreciation, and significant tax advantages.

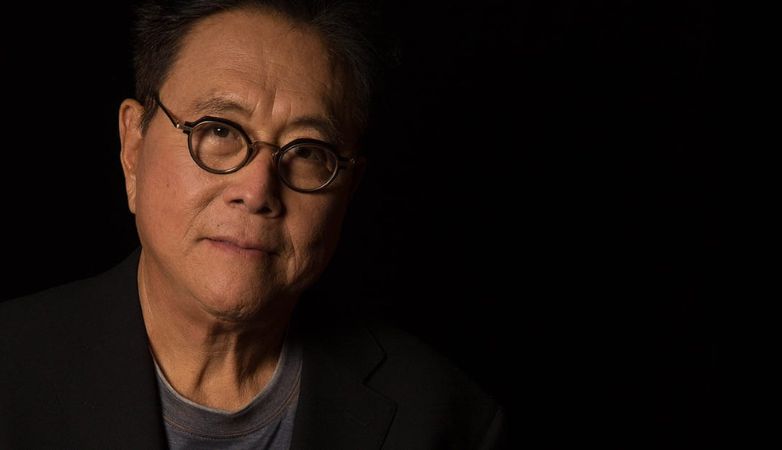

About Robert Kiyosaki (author)

Robert Kiyosaki is a famous author, entrepreneur, and investor known for his popular book “Rich Dad Poor Dad.” The book has sold over 32 million copies worldwide and translated into more than 51 languages. Kiyosaki’s book emphasizes the importance of financial education and literacy, urging readers to take control of their financial future.

Aside from being an author, Kiyosaki is also a successful entrepreneur and investor, having founded the Rich Dad Company, which offers financial education and training programs. He has also written several other books on personal finance, including The Cashflow Quadrant, The Business of the 21st Century, Rich Dad’s Guide to Investing, Retire Young Retire Rich”, Why We Want You to Be Rich, and many other fantastic books.

He promotes cultivating a “rich dad” mindset, which involves taking calculated risks, understanding the difference between assets and liabilities, and establishing passive income streams. Kiyosaki’s teachings have inspired many readers to pursue financial independence, making him a respected figure in the financial industry.

Conclusion

In the codex “Rich Dad Poor Dad,” the author Robert Kiyosaki concludes that financial knowledge and literacy are critical components in obtaining monetary freedom and accumulating affluence. His teachings concentrate on cultivating a mindset akin to a “rich dad,” which encompasses taking informed risks, comprehending the discrepancy between assets and liabilities, and establishing passive income streams.

The book also introduces a vital concept called the Cashflow Quadrant, which groups individuals into four classes based on their income sources, underlining the importance of transitioning from employee status to that of the business owner or investor.

Moreover, Kiyosaki accentuates the significance of investing in oneself, evading debt, and fostering a positive attitude towards wealth and money. The narrative additionally stresses the importance of generating passive income streams, enabling one to attain financial independence and pursue their ambitions and interests.